1. Check your credit score and credit reports regularly

The first step in ensuring your credit score is as high as possible is to ensure that your credit report is accurate. This step begins with obtaining copies of your credit reports from the three major credit bureaus (TransUnion, Equifax and Experian). Under federal legislation, each American consumer is permitted one free copy of his or her credit report annually from each of the three major credit bureaus. Oftentimes, it makes sense to pull copies of your report from each of the three at once, that way you can compare each of your reports to ensure they are consistent and do contain any errors.

2. Review your reports and dispute any errors immediately

Most consumers are shocked when reviewing their credit reports for the first time at how many errors and differences between your credit reports at each of the three major credit bureaus there are. These errors are often due to sloppiness by the credit bureaus rather than poor financial practices on a consumer’s part, which is one reason it is so important to regularly review your credit reports and immediately correct any errors you find.

Correcting an error or filing a dispute with one of the credit bureaus is as simple as contacting the applicable credit bureau to report the error or register your dispute. Once you have taken that step, the credit bureau has 30 days within which to investigate and take action as to your complaint. If the dispute is resolved in your favor, you will often be amazed that your score often immediately jumps.

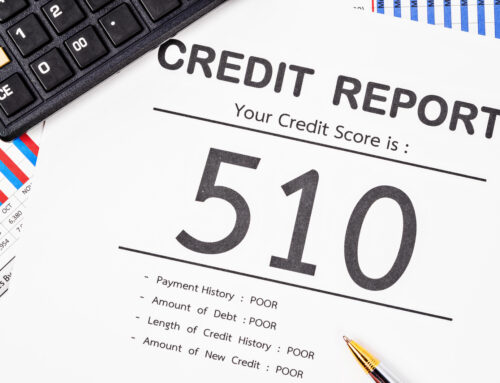

3. Establish positive personal financial habits to increase your credit score

The best way to think of your credit score is as a personal financial report card. If you consistently set and strict to a budget and practice other positive financial habits, then your score will reflect these positive habits.

However, even if you do not have a perfect credit score, learning how to improve your credit score is not that difficult. The most important factor in doing so is to make all your required payments on time. Due to the fact that your payment history is 35% of your credit score, simply making your required payments on time will help to improve your credit score. Auto-payment is offered by virtually every lender or financial institution and can automate the process of ensuring all your payments are made on a timely basis every month, which will naturally help to increase your credit score over time.

Making sure to follow a budget and keeping your credit utilization rate low are two other ways to quickly improve your credit score.

4. Taking consistent small steps to boost your credit

Improving your credit score takes patience, but it often consists of many small steps that can have a large cumulative effect over time. For example, closing an account that you have not used in years from a store card that you signed up for five years ago for a one time discount with a small limit may help reduce your outstanding accounts. However, it is also important to consider the age of the particular account. If it is the credit card you have had since you graduated from high school, chances are that it is helping to boost your credit score by keeping the average age of your accounts high, so that may be an account you want to keep open.

Leave A Comment